Activity statements are used to make payments and report obligations under the tax system. The statement is used to report and pay your FBT Instalments, PAYG (instalments and withholding), GST and related tax obligations, and to pay deferred company and superannuation fund instalments.

The ATO website provides instructions on how to complete sections of the activity statement:

Activity Statement

Activity statements are used to make payments and report obligations under the tax system. The statement is used to report and pay your FBT Instalments, PAYG (instalments and withholding), GST and related tax obligations, and to pay deferred company and superannuation fund instalments. The ATO website provides instructions on how to complete sections of the activity statement:

- FBT (Fringe Benefit Tax)

- GST (Goods and Services Tax)

- LCT (Luxury Car Tax)

- PAYG (Pay As You Go) Instalments

- PAYG (Pay As You Go) Withholding

- WET (Wine Equalisation Tax)

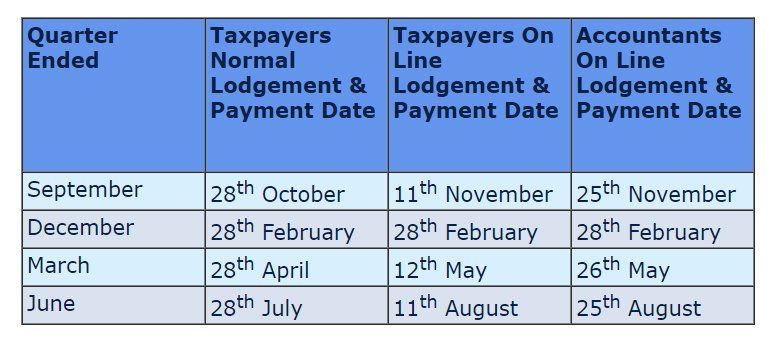

If your annual turnover is less than $20 million, you can lodge your Business Activity Statement monthly or quarterly. However, if your annual turnover is $20 million or more, you must lodge your Business Activity Statement and make payments electronically every month.

FURTHER INFORMATION: The ATO website provides answers to some common questions about the Activity Statement.